Life Insurance policies from Bajaj Allianz offer best tax saving plan to help you save upto Rs...u/s 80C. You can also save tax u/s 80CCC, 80D and 80 DDD

Tuesday, 19 July 2016

Saturday, 16 July 2016

Tax Saving Tips: Keep More of Your Hard Earned Money in Your Pocket

During Tax Season, everyone's biggest concern is how to keep

from paying in more taxes. Often it's too late during those lag months to do

anything different, but there are a few things you can do now to plan for next

year.

1. Put a Tax Savings

Plan in Place, and Use It.

Discuss your tax issues with your Tax Preparer and put a

plan in effect now for this year's income to save money on next year's taxes.

By creating a Tax Plan & Budget now, you will have an active lead on what

you should be doing during each quarter, not only to make your business more

profitable, but also to save those extra dollars you pay to IRS and the

Government.

2. Use investment,

tax deferment, and alternate income sources to cut taxable income.

Invest in your future, for a time when you won't be making

as much money, so you'll have a lower tax bracket. Put money in savings for

your children's education and defer your tax costs until you have fewer

children at home to support. IF your children literally do work in your

business, put them on the payroll, let them pay their own expenses for summer

camp and education, and reduce your tax burden. They paychecks are deductible,

summer camp and education is not.

3. Adjust billing,

collection, and payables for maximum tax advantage.

Yes you can defer billing a client until after the New Year,

to avoid taxing that income in the current year. It may or may not be

advisable, depending on the client. Prepaying for long term services can

increase your deductions. Providing you really do use the services, this is an

excellent method of reducing taxes.

4. Document your

expenses, keep good records, and write a daily activity diary.

Document everything, no matter how trivial; keep good

records of your activities and expenses related to business. When your receipts

are confirmed by a diary entry, IRS can't argue with your deductions.

5. Be a Good Steward

of your Money.

When your bills are due, pay them. IRS understands the value

of punctuality. They charge penalties for being late. Penalties increase your

Tax Debt. So, it's always best to pay your Tax bills when they are due or

before.

Donations, time, money, and objects are deductible on some

level, keep good records to determine your legal donation limits and prevent

overpayment of taxes.

6. Work from Home

Home based businesses get the cream of Tax Deductions. These

deductions are legitimate if you have proof. Your daily diary will provide

active proof of your business operations, duties, and deductible expenses. If

in doubt write it down. Ask your tax preparer to be certain.

7. Incorporate Your

Business

Corporations pay less for the same Taxable income. In

general, this statement is true. However, before going to the expense of

incorporating your business, ask your Tax Preparer to advise you. It may not

save enough money to pay for the legalities of incorporating.

There are many ways to save money on your Tax Saving Plans.

These are just a few of the more popular methods. If you'd like more

information, contact your Tax Preparer.

Source: http://blogs.rediff.com/taxsavingplans/2016/07/16/ritikashah11998-20/

Friday, 15 July 2016

Thursday, 14 July 2016

Tax Saving Plan for Employed People

Employed people have less scope for tax savings as compared

to self-employed people.

If you are currently employed, the income and benefits from

and related to your employment are taxed and you cannot claim any deductions

against employment income except that are specifically allowed by the system.

Here are

some taxes planning techniques which can lead to save taxes:

• Arrange to get nontaxable benefits: There are

some employment benefits which are not taxable like contributions to a

registered pension plan, contributions to a group sickness or accident

insurance plan, contributions to a private health services plan, all or portion

of the cost of free or subsidized school services for your children.

• Ask to have your source withholdings reduced wherever

possible: In any situation where you expect to receive a refund after

filing your return, you should review the form which you file with your

employer and seek to have source with holdings reduced. If you get a refund,

that means the has been holding your money and not paying you interest on it

for many months. It is better you can send a cheque to at filing time so that

you can use that funds in the meantime.

• Pay interest owing on loan from employer by January 30

of the following year:

If you receive a low interest -free loan from your employer,

you are considered to have received a benefit from employment. The benefit is

set at the CRA's current prescribed rate of interest minus any interest you

actually pay during the year or within 30 days after the end of the year. This

will provide you with a cash flow advantage.

• Consider employee's profit sharing plans for cash flow

purposes: there is no source withholding on the amounts paid by the

plan to you. Careful timing of the employers' contributions and the Tax Saving Plans disbursements

can give you better cash flow than would a straight bonus payment.

• Transfer retiring allowances to an RRSP: If you

transfer the entire retiring allowance into an RRSP, the legal fees will never

become deductible. When you take payments out of the RRSP, they are no longer

considered a retiring allowance.

• Claim the employment tax credit to help cover your

work related expenses: Employees can claim a 15% tax credit to help cover

their work related expenses.

• Employed trades people can claim the deduction for the

cost of new tools: If you are an employed trade person and you must use

your own tools on the job, you can deduct the portion of the cost of new tools.

• You can claim rebate for GST/HST paid on expenses

deductible from your employment income.

Source: http://blogs.rediff.com/taxsavingplans/2016/07/14/ritikashah11998-19/

Wednesday, 6 July 2016

Tax Saving Plans - A Must for Everyone

What does one mean by income tax savings? What are the

different tax saving plans etc. These are some of the terms which one needs to

be aware of. To make sure that your hard earned money stays with you, it is important

for you carry out an extensive research when it comes to tax savings. The

income that you earn annually is subject to the Income Tax laws governing that

country. The tax rates are not fixed and are based on the income that you earn

throughout the year. But, one can save a lot on tax money, only if he or she

plans it the proper way and takes wise steps at different stages of life.

So if the question how to save tax is mind boggling you, well

we'll help you out with the best solutions. To extract maximum tax benefits,

you need to invest your earnings in various tax savings schemes. These tax

saving investments come with loads of features and benefits. With the help of

tax deduction, a break granted by the government, some part of your income is

excluded when it comes to calculating government tax.

Apart from this, you can also invest in long term Best Tax Saving Plan investments

like pension savings plan for a life after retirement or a life cover to secure

your family's future. Which means that tax saving plans do not just reduce your

taxable income but also help you and your family have a secured future.

Now let's come to saving tax through life insurance policies.

Life insurance policies are one of the best ways to save tax as under the

Income Tax Act 1961 (Act), when investing in a life insurance plan, the

premiums that you pay when calculating taxable income are waived off. So the

assured sum and the profit which you receive are all exempted from tax. What's

more? By investing in a Life Insurance Scheme, you get double the tax benefits.

Now isn't that what you call a win-win situation.

Moreover, apart from this investing in a health insurance

scheme can also generate great tax benefits. Along with money saved from tax,

you secure yourself from any uncertainties in life like illness, accident etc.

So to make sure that your money stays in your hand and you can give your family

a good life, go ahead and invest in the best schemes as far as your taxes are

concerned. It is a time tested that only the best investment plans guarantee a

safe and sound return.

The author has a deep knowledge on the tax instruments and

has been associated tax saving investments for over a decade now. And has a

deep knowledge on the options to choose from.

Source: http://blogs.rediff.com/taxsavingplans/2016/07/06/ritikashah11998-18/

Monday, 4 July 2016

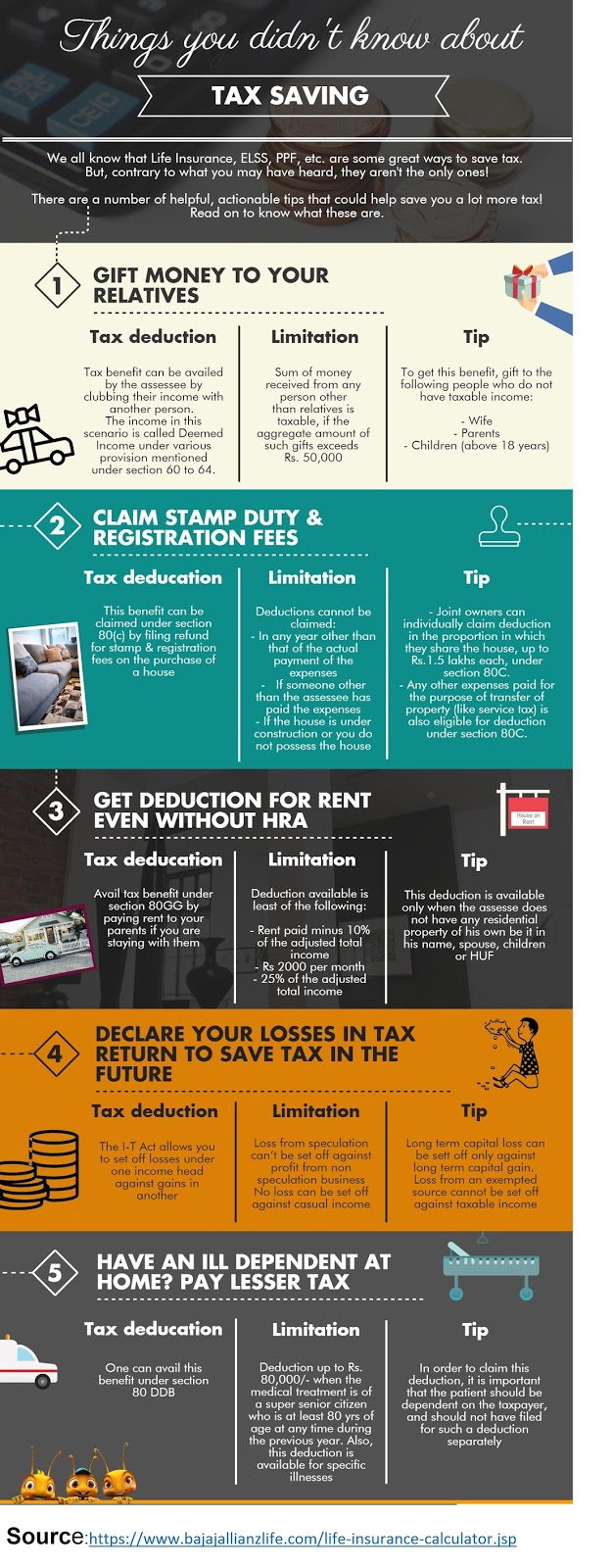

6 Tips That Can Help You Save A Lot More Tax

Planning your money right can help you save a lot that you

otherwise end up paying as tax. If you take the right measures, you can reduce

your taxable income, hence saving a lot more than usual. If you recently joined

the tax-paying brigade or aren’t sure about where to look for tax savings,

don’t worry! We have answers to all your questions related to Tax

Saving Plan.

Here are six tips

that can help you save a lot of tax:

1. Save tax on rent payment

If you’re living in rented accommodation, your employer is

supposed to give you some part of this money as House Rent Allowance (HRA). If

you stay with your parents, you can avail tax benefits under section 80GG by

paying the monthly rent to them. You can claim the least of the following:

·

25 per cent of the total income or

·

2,000 per month or

·

Excess of rent paid over 10 per cent of the

total income

The HRA tax deduction limit has been increased from Rs.

24,000 to Rs. 60,000 in this Union Budget. However, this deduction isn’t

available if you have a residential property in your name or in your spouse’s

or child’s name.

2. Pay less tax if you’ve an ailing dependant

at home

Under section 80 DDB, you can get some tax benefits if you

have an ill dependant at home. You get to avail a deduction of up to Rs. 80,000

for the medical treatment of a super senior citizen who’s at least 80 years

old. If the person is between 60 and 80 years, it will be Rs. 60,000 and if the

person is below 40 years, the exemption is Rs. 40,000. This deduction, however,

is available for some specific illnesses and you can claim them only if the

ailing person hasn’t filed for any such deduction separately.

3. Invest in ELSS funds

Investing in ELSS funds is the most prudent way to reduce

your taxable income. Because of their great potential and high liquidity, they

are one of the most preferred investment options. If you’ve already fulfilled

your KYC requirements, you’re eligible to invest online. Otherwise, you need to

go through the KYC screening process first.

4. Invest in ULIPs

ULIPs are something you can opt for as you

get to avail the benefits of an insurance policy as well as an investment. Some

of the ULIPs even cost less than direct Mutual Funds, and unlike ELSS funds,

you can switch your corpus from equity to debt and vice versa. Since all

insurance plans enjoy a tax exemption under Section 10 (10d), there’s no tax

implication on the gains made from switching. Don’t forget to check the cost of

the ULIP before investing.

5. Restructure your salary

If you bear some expenses just because you’re working in a

particular company, you can always ask your employer to restructure your pay.

You can claim to avail various perks and allowances. All you need to do is give

a proof of these expenses to avail a tax-free allowance. Some such allowances

that fall under this category are:

·

Conveyance

·

Medical treatment

·

Telephone and mobile

·

Books and magazines

·

Uniform

Since these allowances are given according to your grade,

you can’t ask for all of them. Your employer has the right to decide your eligibility

for these.

6. Leave travel allowance and medical expenses

Most employers give part of your salary as medical expenses.

If you start collecting medical bills and produce them when needed, this

allowance can become tax-free for you. The upper limit, however, for these

expenses is Rs. 15,000 in a financial year. If you have any dependents, you can

produce their medical bills as well. Similarly, depending on the HR policies of

your company, you can also avail leave travel allowance that can be claimed if

you go on a vacation. You need to produce the actual bills and receipts here as

well.

[ Source : https://blog.bankbazaar.com/6-tips-that-can-help-you-save-a-lot-more-tax/

]

Monday, 27 June 2016

Wednesday, 18 May 2016

Many in India Still Think That Insurance is an Avoidable Expenditure

The insurance sector has only 2% penetration in Indian market

largely to the fact that Indians see it as an avoidable expenditure. Many in

India don’t see the urgency to get insurance policies. A majority of Indians

still reside in rural areas or lesser developed towns where awareness is

restricted. Large percentage of illiteracy still prevails in major parts of

India. In order to penetrate deeper in the Indian market the insurers need to

spread awareness among the ‘centers of influence’ i.e. the ‘village sarpanch’

in case of villages. Centers of influence can be different for different

people. People mostly get influenced by people on whom they have trust. For

some they can be their family and friends as well. Many people in India still

don’t bother to buy essential insurance policies like health insurance. Reasons

can be many but one of the most common reasons is that people don’t find the

urgency to buy an Life

insurance policy. India is still a developing country and there is

large inequality of income spread. A large number of people somehow manage to

pay bills and any money left after paying bills is mostly spent on leisure or

savings in banks (mostly). Having an insurance policy like term insurance or health

insurance is still thought of as a luxury. It is seen in case of motor

insurance that people in order to avoid challahs or fine get only third party

insurance as it is mandatory. They don’t take comprehensive motor insurance

policies that cover their own vehicle as well. The whole ideology is to save or

avoid paying premium even if they are exposed to a higher financial risk. Many

people mostly in second and third tier cities where traffic checking is less

strict than a city like Delhi don’t even bother to get third party or liability

insurance done for their vehicles. The defaulters are obliged to be penalized

heavily. Still, in order to avoid paying premium they don’t get it done. And

there are many others who still don’t trust that their claim would be paid by

the insurance company when the need arises. Maybe they have seen or witnessed

cases where claims have been rejected by companies. There can be faulty or

fraudulent claims by the policyholder.

Although the scenario has been changing post liberalization

with the advent of many private players in the Indian Insurance market space

there are still paths left to be unblocked. Some of the world’s largest and

most reputed insurance companies partnered with Indian corporate houses have

ventured in India. They have brought international expertise and know how in

the country. With aggressive advertising and transparent disclosures the

insurance industry is expanding. It is still in a very nascent stage. There

have been major alterations and modifications in handling the various

intermediaries in the insurance sector to make insurance selling fairer and

more convenient. The easier accessibility of the internet and rage to buy

everything online among the masses has seen the birth and exponential rise of

online insurance policies being offered by various insurers.

A lot of awareness and trust is still to be spread among the

Indian masses to encourage them to be adequately insured. Insurance is an

extremely importance risk management tool. Not being insured or being

underinsured is a major risk. Being adequately insured gives a person a sense

of self sufficiency and confidence to face adversities. This message has to be

scribbled in the Indian psyche. Insurance is not a mere tax saving scheme

rather it is the most trusted confidant that would come to aide in the most

desperate times. With more education and fair trade practices one can hope to

see a fair insurance market penetration in the country in times to come.

Source: http://tax-saving-plans.tumblr.com/post/144543645260/many-in-india-still-think-that-insurance-is-an

Tuesday, 17 May 2016

Tax-Saving Options that Save Tax and Grow Your Wealth

If you are reading this, you are likely to be someone whose

income exceeds the threshold of Rs 2.5 lakhs for paying taxes. There are some

legitimate ways of saving taxes and the good thing is that most of them also

help you grow your wealth. These options usually have a lock in period and vary

in the nature and amount of return they provide. You must also remember that

each of these alternatives also serve specific purposes and tax saving is not

the purpose but an ancillary benefit of that.

What is pre-determined and what is optional. EPF, Home Loan

repayment and Tuition Fees are pre-determined. Add them up and see how much of

your 1.5 lakh limit is utilized.

ELSS Tax

Saving Mutual Funds

ELSS or Equity Linked Saving Schemes are a kind of

equity-linked mutual funds. As they

invest in equity or stocks, ELSS funds have the ability to deliver superior

returns - 14-16% over the long term. That’s a full 6-8% above inflation. This

return is not guaranteed though but historical evidence suggests that these

returns are achievable over the long term.

Public

Provident Fund

PPF is a good option if you are looking for an option with

certain returns.

Your PPF investments earn interest at a rate announced every

year – currently 8.7%. PPF return is therefore mostly at par with inflation.

However, it is tax-free and you can do a lump sum or small regular investments.

The duration of a PPF account is 15 years which is extendable

by 5 years at a time. You cannot withdraw money from your PPF account except

under certain conditions but not before 5 years.

You can invest in PPF through a bank or Post Office. Ability

to invest online is limited.

Life Insurance

Premium

This was almost the default Tax Saving Plans

option for years, however, over the last few years; most informed investors have

learnt the perils of choosing this option

There are 2 kinds of Life Insurance Policies:

Pure risk also called term life which ensures a risk to the

life of the insured

Risk+ investment: which pay you back money over time

While pure risk life insurance is something everyone with a dependent

must have, it’s not an investment. Life insurance is an expense- something you

pay to ensure that your dependents are not left stranded should something

unfortunate happens to you.

National

Pension Scheme

National Pension Scheme is a lot like investing in mutual

funds with its Safe, moderate and Risky options. The returns are not

guaranteed.

You cannot withdraw until 60 and the corpus amount must

necessarily be invested in an Annuity. The withdrawals are also taxable.

Pension

Funds

Pension funds are designed to provide you with an income

stream post retirement. They come in two flavors: Deferred Annuity and

Immediate Annuity.

For deferred annuity plan, you invest annually until your

retirement. Once you reach your retirement, you have can withdraw up to 60% of

your accumulated corpus and have to re-invest the remaining in an annuity fund

which will give you a monthly pension.

When it comes to immediate annuity plans, you invest a bulk

amount one-time and get monthly pension from the next month itself. You would

typically use these to invest your retirement corpus.

Source: http://tax-saving-plans.tumblr.com/post/144496559495/tax-saving-options-that-save-tax-and-grow-your

Friday, 13 May 2016

Before Buying Insurance Policy to Save Income Tax

Premiums paid towards these insurance plans buy you protection.

What’s more – you can also get tax benefits on the maturity amount/returns from

insurance plans. For employees Jan-Feb is season of submitting income tax

proof. Many people buy insurance policy,

in a hurry, to save tax and submit the proof to employer. Buying an insurance

policy is a long time commitment, similar to marriage. So It is advisable to

understand all aspects of claiming tax benefit in buying insurance policy. Let us examine these aspects in detail as per

current income tax laws.

What is tax

benefit available for insurance policy?

Any amount paid to an insurer to buy or to keep a life

insurance policy in force can be claimed as a deduction from gross total income

by the policy holder. So premium paid for a life insurance policy can be

deducted from gross total income before arriving at taxable income subject to

certain conditions.

Life insurance plans are eligible for Best Tax Saving Plan deduction

under Sec. 80C. Deduction benefit up to Rs 1.5 lakh under Section 80C. Section 80C relates to deduction allowed

under investments in instruments like PPF, insurance and pension policies.

Pension plans are eligible for a tax deduction under Sec.

80CCC. Deduction benefit up to Rs 1.5 lakh under Section 80CCC.

Health insurance plans/riders are eligible for tax deduction

under Sec. 80D. You can get a tax deduction of maximum Rs 25,000 on the health

insurance premium for self and family. If you are a senior citizen, you can

claim tax deduction on the premium of up to Rs 30,000.

Combined Limit of deduction under Sec 80C & 80CCC &

80 CCD is Rs 1, 50,000.

The proceeds or withdrawals of our life insurance policies

are exempt under Sec 10(10D), subject to norms prescribed in that section.

Who can get the tax benefit on premium paid for a life

insurance policy?

On whose name should the life insurance policy be to claim the

tax benefit?

An individual can only claim tax benefit under Section 80C of

the Income tax Act, 1961, on life insurance policy(s) bought in the name of

self, spouse or children. You can buy a life insurance policy for any number of

your children irrespective of whether they are minor, major, married, unmarried

or adopted. A policy taken in the name of any other person won’t be eligible

for any tax benefits. So life insurance premium paid by you for your parents

(father / mother / both) Brother, Sisters or your in-laws is not eligible for

deduction under section 80C.

Source: http://tax-saving-plans.tumblr.com/post/144290926275/before-buying-insurance-policy-to-save-income-tax

Tuesday, 10 May 2016

Saturday, 7 May 2016

How to save taxes as a salaried individual?

Salaried individuals are one class of people that have to pay

maximum taxes in our country. This often leads to disappointment among salaried

individuals. Of course, who would be happy knowing that half of the hard earned

income has been deducted in the form of taxes? But with the right tax planning

strategies, it is possible to save your income from tax liabilities. Here are

few ways that will help you save taxes as a salaried individual.

Restructure

your salary: We often spend money from our own account on expenses which

are actually company’s or employer’s requirement. For example, if you wear a

uniform for your job’s sake or talk to a client with your own mobile phone.

Such expenses should be certainly covered by your employer. Ask for the

restructuring of your salary, if you are the one who is paying for the

following expenses.

Some allowances which save tax

Conveyance

Newspaper, Books and Magazine

Medical Treatment

Uniform

Telephone and Mobile

Office Entertainment

Make use of

section 80C: Under section 80C, you can avail a maximum tax deduction of

Rs 1 lakh by investing in any of the following options

ELSS(Equity linked saving scheme)

Public provident fund

Life insurance policy

Fixed deposits

National

saving certificates.

Save tax on

rent payment: You may be working outside your city and do not have a

company accommodation. Expenses on rent payment should be deductible from your

taxable income. House rent allowances include 25 % of the total income.

However, the deduction will not be allowed if you own a residential house in

that location.

Reimburse

travel and medical expenses: Personal expenses such as travel

and medical are also tax deductible. Although you will be required to provide

proper receipts and bills in order to claim the deduction. Deduction, under

this category, is limited up to Rs 15,000.

Tax saving

from home loans: As a salaried individual, you will always consider a

home loan option before buying a house. In such case, do not forget to take

into account tax deductions which are applicable to both principal payments as

well as interest payment. Section 80C offers deduction up to Rs 1 Lakh on

principal component of your home loan.

Apart from considering all the above Tax Saving Plans options,

consult a professional tax planner to avoid any last minute hassle. It is

important to start your tax planning well before 31st March and to file your

returns before the 31st of July each year.

Source: http://tax-saving-plans.tumblr.com/post/143984905105/how-to-save-taxes-as-a-salaried-individual

Wednesday, 4 May 2016

Saturday, 30 April 2016

All About Deduction Under Section 80C And Tax Planning

Background for Section 80C of the Income Tax Act (India) / what

are eligible investments for Section 80C:

Section 80C replaced the existing Section 88 with more or

less the same investment mix available in Section 88. The new section 80C has become effective

w.e.f. 1st April, 2006. Even the section

80CCC on pension scheme contributions was merged with the above Section

80C. However, this new section has

allowed a major change in the method of providing the tax benefit. Section 80C of the Income Tax Act allows

certain investments and expenditure to be tax-exempt. One must plan investments well and spread it

out across the various instruments specified under this section to avail

maximum tax benefit. Unlike Section 88, there are no sub-limits and is

irrespective of how much you earn and under which tax bracket you fall.

The total limit under this section is Rs 1.50 lakh from financial

year 2014-15 / Assessment Year 2015-16. Before FY 2014-15 the limit was Rs. 1

Lakh. Under this heading many small savings schemes like NSC, PPF and other

pension plans. Payment of life insurance premiums and investment in specified

government infrastructure bonds are also eligible for deduction under Section

80C

Most of the Income Tax payees try to save tax by saving under

Section 80C of the Income Tax Act.

However, it is important to know the Section in to so that one can make

best use of the options available for exemption under income tax Act. One important point to note here is that one

can not only save tax by undertaking the specified investments, but some

expenditure which you normally incur can also give you the tax exemptions.

Besides these investments, the payments towards the principal

amount of your home loan are also eligible for an income deduction. Education

expense of children is increasing by the day. Under this section, there is

provision that makes payments towards the education fees for children eligible

for an income deduction

Sec 80C of the Income Tax Act is the section that deals with

these tax breaks. It states that qualifying investments, up to a maximum of Rs.

1.50 Lakh , are deductible from your income. This means that your income gets

reduced by this investment amount (up to Rs. 1.50 Lakh), and you end up paying

no tax on it at all!

This benefit is available to everyone, irrespective of their

income levels. Thus, if you are in the highest tax bracket of 30%, and you

invest the full Rs. 1.50 Lakh, you save tax of Rs. 45,000. Isn’t this great?

So, let’s understand the qualifying investments first.

Qualifying

Investments

Provident

Fund (PF) & Voluntary Provident Fund (VPF): PF is

automatically deducted from your salary. Both you and your employer contribute

to it. While employer’s contribution is exempt from tax, your contribution

(i.e., employee’s contribution) is counted towards section 80C investments. You

also have the option to contribute additional amounts through voluntary

contributions (VPF). Current rate of interest is 8.5% per annum (p.a.) and is

tax-free.

Public

Provident Fund (PPF): Among all the assured returns small saving schemes,

Public Provident Fund (PPF) is one of the best. Current rate of interest is

8.70% tax-free (Compounded Yearly) and the normal maturity period is 15 years.

Minimum amount of contribution is Rs 500 and maximum is Rs 1, 50,000. A point

worth noting is that interest rate is assured but not fixed.

Life

Insurance Premiums: Any amount that you pay towards life insurance

premium for yourself, your spouse or your children can also be included in

Section 80C deduction. Please note that life insurance premium paid by you for

your parents (father / mother / both) or your in-laws is not eligible for

deduction under section 80C. If you are paying premium for more than one

insurance policy, all the premiums can be included. It is not necessary to have

the insurance policy from

Home Loan

Principal Repayment: The Equated Monthly Installment (EMI) that you pay

every month to repay your home loan consists of two components – Principal and

Interest. The principal component of the EMI qualifies for deduction under Sec

80C. Even the interest component can save you significant income tax – but that

would be under Section 24 of the Income Tax Act. Please read “Income Tax (IT)

Benefits of a Home Loan / Housing Loan / Mortgage”, which presents a full

analysis of how you can save income tax through a home loan.

Stamp Duty

and Registration Charges for a home: The amount you pay as stamp duty

when you buy a house, and the amount you pay for the registration of the

documents of the house can be claimed as deduction under section 80C in the

year of purchase of the house.

Infrastructure

Bonds: These are also popularly called Infra Bonds. These are

issued by infrastructure companies, and not the government. The amount that you

invest in these bonds can also be included in Sec 80C deductions.

Pension

Funds – Section 80CCC: This section – Sec 80CCC – stipulates that an

investment in pension funds is eligible for deduction from your income. Section

80CCC investment limit is clubbed with the limit of Section 80C – it maeans

that the total deduction available for 80CCC and 80C is Rs. 1.50 Lakh. This

also means that your investment in pension funds up to Rs. 1.50 Lakh can be

claimed as deduction u/s 80CCC. However, as mentioned earlier, the total

deduction u/s 80C and 80CCC cannot exceed Rs. 1.50 Lakh.

Senior

Citizen Savings Scheme 2004 (SCSS): A recent addition to section 80C

list, Senior Citizen Savings Scheme (SCSS) is the most lucrative scheme among

all the small savings schemes but is meant only for senior citizens. Current

rate of interest is 9.20% per annum payable quarterly. Please note that the

interest is payable quarterly instead of compounded quarterly. Thus, unclaimed

interest on these deposits won’t earn any further interest. Interest income is

chargeable to Best Tax

Saving Plan . The account may be opened by an individual,

Who has attained age of 60 years or above on the date of

opening of the account?

Who has attained the age 55 years or more but less than 60

years and has retired under a Voluntary Retirement Scheme or a Special

Voluntary Retirement Scheme on the date of opening of the account within three

months from the date of retirement.

No age limit for the retired personnel of Defense services

provided they fulfill other specified conditions.

Source: http://bestsavingsplan.tumblr.com/post/143625123529/all-about-deduction-under-section-80c-and-tax

Friday, 29 April 2016

Monday, 11 April 2016

Friday, 4 March 2016

Quick tips to save tax through insurance

Come March and all of us will be busy in calculating our tax

liabilities. In fact, most organisations start asking for proofs of investment

under tax exempted instruments by January itself.

Thus, this is the time when one can review his or her tax

liabilities and take necessary actions. As you may already be aware that this

year the income tax exemption limit towards life insurance has increased from

Rs 1 lakh to Rs 1.50 lakh. It is a significant jump of flat 50 per cent. This

exemption can be claimed under section 80C of the Income Tax Act.

But, are you going to take advantage of this move? Of

course, you should. Unfortunately, there are millions of people who had been

investing in insurance as per the previous limit of Rs 1 lakh. But it is still

not late and you can take a corrective action.

What about pension

funds?

If you are thinking of investing in a long-term pension

fund, then you can claim tax benefit under section 80CCD of the Income Tax Act.

The deduction under this section can be availed up to Rs 1 lakh.

Although, the pension which you receive after the policy

tenure is applicable to income tax. The percentage of tax depends upon the

amount of your gross taxable income.

Section 80 CCE of the Act specifies that the total limit of

deduction under the abovementioned sections – 80C and 80CCD comes to Rs 1.50

lakh.

Deduction under

health insurance

After life insurance, you can further claim income tax

deduction with respect to premium paid towards health insurance. There is a

provision of deduction up to Rs 15,000 towards health insurance.

This is further added up by Rs 20,000 towards health insurance

premium paid for parents above 60 years of age. If parents are below 60 years,

then the tax deduction would be Rs 15,000. Tax payers, who fall in the category

of senior citizens, can also claim the deduction of Rs 20,000.

Are you worried about

low returns?

A large number of people appreciate life insurance plans

because of their dual benefit of risk coverage and tax exemption. But there is

always a concern on the low rate of returns offered by these plans. It is

observed that most plans offer annual returns in the range of 5-8 per cent.

This rate of return is even lower than average rate of

inflation. Thus, investing in insurance is not preferred by people who wish

high return on investment. They may invest some amount to cover risk and get

some exemption but they always aspire to invest in other instruments such as

equities and real estate. Is there a solution?

Well, we cannot say anything about real estate, but yes, you

can always invest in equities and insurance altogether. Unit Linked Insurance

Plan (ULIP) are the potential solution.

These plans are also recognised for Tax

Saving Plans exemption under section 80C and there is an added benefit of

investing in equity markets. You can always the allocation of your premium in

traditional debt instruments and equities to balance risks. For instance, you

can specify that 40 per cent of your premium should be invested in equities and

the rest in government securities. This helps is enhancing the average rate of

returns on you investment.

For instance, you invest Rs 1 lakh in ULIPs, specifying that

Rs 60,000 should be invested in government securities and the rest in equity

markets. Now, in a year if your plan generate 9 per cent on government

securities and 15 per cent from equity markets, your total return will be as:

Rs 5,400 from securities and Rs 6,000 from equities. This will bring you a

return of Rs 11,400 in total – 11.4 per cent returns per annum.

In the long run, you are able to enjoy the power of

compounding. ULIPs have a lock-in period of 3-5 years, and you are somehow

bound to think long term. If you tend to withdraw the premium before this

period, the deductions are as high as 30 per cent.

From these perspectives, all the insurance plans have such

conditions in place. That means, if you withdraw premium amount before a

certain period, which is generally 3-5 years, then the penalties fall in the

range of 30 per cent. Thus, it is better to invest in insurance from a long

term perspectives, and it really works, providing you a sizeable corpus.

Saturday, 20 February 2016

YOUR FAMILY CAN HELP YOU SAVE TAXES – HERE’S HOW

This is time of the year when we are scurrying to put

together our investment proofs and tax savings documents. You family can help

you save taxes too, let’s find out how.

Health insurance – The pressures of modern living have put

our health at greater risk. While most employees have a medical insurance cover

from their employer, it usually only covers hospitalization. Buying a medical

insurance cover for your spouse, children and parents to cover common ailments

has tax benefits too. For you and your spouse & children a deduction of Rs

25,000 and for parents an additional Rs 30,000 can be claimed under section

80D. You can also avail tax benefits under section 80D if you purchase a term

insurance plan with a critical illness benefit. Do remember to pay the annual

premium at this time, so you can claim the entire amount as deduction in your

tax return.

Medical check-ups – Included in the amount for deduction

under section 80D is health check-ups for your family. If you do not want to go for medical insurance,

getting a preventive health check-up done for your family will help you save

taxes. Several hospitals and clinics offer preventive health check-up packages.

A maximum of Rs 5,000 can be claimed for you, your spouse’s and your children’s

health check-up. Rs 5,000 can also be claimed for health check-up of your

parents. These amounts however are within the overall limit of section 80D. You

can get both medical insurance as well as preventive health checkup but the

total deduction cannot exceed the amounts specified above.

Life insurance premium – Buying a life cover for you &

your family can save you taxes. The premium paid is allowed as a deduction

under section 80C. The policy must be in the taxpayer’s or spouse’s or any

child’s name (the child may be dependent/independent, male/female, minor/major,

or married/unmarried). A maximum of Rs 1,50,000 can be claimed under section

80C. If you intend you purchase a life insurance policy do check the premium

commitments, terms and the cover in detail. You’ll have to pay the premium over

a number of years and do not make the decision in haste to save taxes.

Rent on accommodation – If you are living with your parents,

you can pay them rent and save tax on HRA. Enter in to a rent agreement with

your parents and pay them the monthly rent. Your parents will include this

rental income in their tax return. If the house is jointly owned they can split

the income in the ratio of their ownership. If they are in a lower tax bracket

or do not have taxable income, as a family you’ll end up saving tax. For

parents who are more than 60 years old the exemption limit is Rs 3,00,000 and

for parents older than 80 years, the exemption limit is Rs 5,00,000. So if they

this rental income keeps them under the exemption limit, you’ll have greater

tax benefits The rental income earned by them can be further invested in

Tax Saving Plans free instruments such as

ELSS or senior citizen’s savings scheme or fixed deposits.

Tuition Fees – Any sum paid as tuition fees (excluding

payment towards development fees/donation/similar nature payment) to any

university/college/educational institution in India for full time education of

any two of your children, is deductible under section 80C. This is an expense

that you have already incurred and you can claim it in your return and save

tax. A maximum of Rs 1,50,000 can be claimed under section 80C.

Your family can help you save tax on your hard earned money.

Monday, 15 February 2016

Save a Month’s Salary in Taxes

It is the last quarter of the financial year, and hence the

ideal time for tax planning if you haven’t done it already.

At this juncture, it is important to keep in mind that your

annual package is directly proportionate to your tax liability, meaning, as

your income increases, your tax liability increases as well.

The annual tax liability of an individual is almost equal to

one month’s salary. However, even after the basic deductions, such as EPF and

HRA, at the employer’s end, you end up sharing a substantial percentage of your

salary with the taxman.

For instance, an individual with a take-home salary of

Rs.50,000 a month accrues an annual tax liability of Rs.46500 which is almost

equal to the take-home amount.

Depending on your tax slab, you can save up to Rs.45,000 in

income tax by claiming deductions under Section 80C and up to Rs.4,500 by the means of claiming deductions under

Section 80D.

Investing in the following instruments can help you claim

deductions with accordance to Section 80C and Section 80D of the income-tax act

and eventually, legally save tax:

Term Plans

Term plans require a higher level of commitment and offer

modest returns; this is why term plans are not considered as good means of

saving on taxes.

A term insurance plan requires you to pay premiums for a

definite period of time and provides risk coverage.

If the insured person expires during the policy term, the

beneficiary is entitled to the insured sum, but, if the person survives the

policy cover period, then survival benefits are not given to the beneficiary.

Hence, this product does not interest buyers.

However, from a tax-saving perspective, all insurance plans

are equal before the law. Therefore, irrespective of the kind of life insurance

plan, you get equal tax benefits.

As life insurance falls under EEE (i.e. Exemp-Exempt-Exemp)

category, both, the premium paid as well the sum assured is exempt from income

tax.

For instance, if a non-smoker starts at an age of 25, then

paying nearly Rs.15,000 per annum can get him a sum assured of nearly Rs.3

crores.

The amount of Rs. 15000 that you pay towards premiums will

be treated as a deduction from your taxable income, while the sum assured will

be a totally tax-free income.

Health Insurance

You can claim for tax deductions against the money spent for

medical expenses for self or a dependent family member.

An individual can claim maximum deduction of Rs. 30,000 u/s

80D. This deduction includes Rs.15,000 for himself and family and the rest

Rs.15,000 for parents.

However, if the parents are senior citizens the deduction

allowable for them is Rs. 20000. This benefit is available over and above the

deductions of Rs. 1.5 lacs under Section 80C.

For example, if an individual with a package of Rs.10 to 15

lacs per annum invests about Rs.7,000 per annum towards a health insurance

plan, then he can get a sum assured of Rs.10 lacs. This premium of Rs.7,000 can

be treated as a deduction from the taxable income.

There are 4 kinds of health insurance plans that you can

choose from. This includes medical insurance plan, hospitalization plan, super

top-up plan and critical illness plan.

Child Plans

It is not necessary to start planning for your child after

you have one. You can start saving and investing as soon as you get married.

As we are already aware, the cost of education is growing

much faster than inflation. Fee for higher education is not what it used to be

about 15 to 20 years ago.

Pursuing a master’s degree from a leading management school

now a days costs you around 14 to 15 lacs or may be higher.

Hence, to avoid financial crises in future, it is imperative

for parents to start saving for our children’s secure future as early as

possible.

Along with securing your child’s career and future, these

plans save you a substantial amount of tax as well. They not only allow you to

claim deductions in the year of investment but also ensure a tax-free return to

your child in future.

For example, if an individual buys a child plan as soon as

his child is born, and pays approximately Rs.72,000 per annum for 20 years,

then his child would get a sum assured of Rs.30,00,000 lacs post maturity.

However, both the premium and the sum assured will be

tax-free only if the annual premium is less than 10 % of the total sum assured.

I the annual premiums exceed 10 % of the sum assured, then

the premium only up to that limit will be exempt and the entire sum assure will

be taxable under the head ‘income from other sources’.

Retirement Plans

It is wise to start planning for your retirement as soon as

you start earning; because later you start the more you pay towards premiums,

which can make it difficult for you to set aside a sufficient corpus for the

golden years of your life.

The income tax act states that any amount paid to keep a

retirement policy in force is eligible to be claimed as a deduction under

section 80C.

Therefore, the entire amount paid by you, inclusive of

service tax and any other charges if collected by the insurer, can be deducted

from your taxable income.

Amount that can comfortably fulfill of your current

requirements will not be sufficient meet your requirements when you turn 65;

reason being, the rising cost of living and the shooting inflation rate.

Hence, it is imperative for you to save for your calm

future.

NOTE: Pension plans offered by insurance companies give you

similar Tax Saving Plans benefits as retirement schemes by

mutual fund companies.

You can claim a deduction of up to Rs.1 lac from the amount

of premium paid towards a pension plan under Section 80CCC of the Income Tax

Act. While, one-third of the maturity amount withdrawn will also be tax free.

Monday, 18 January 2016

5 Best Tax Saving Options & Plans for Financial Year 2015-16

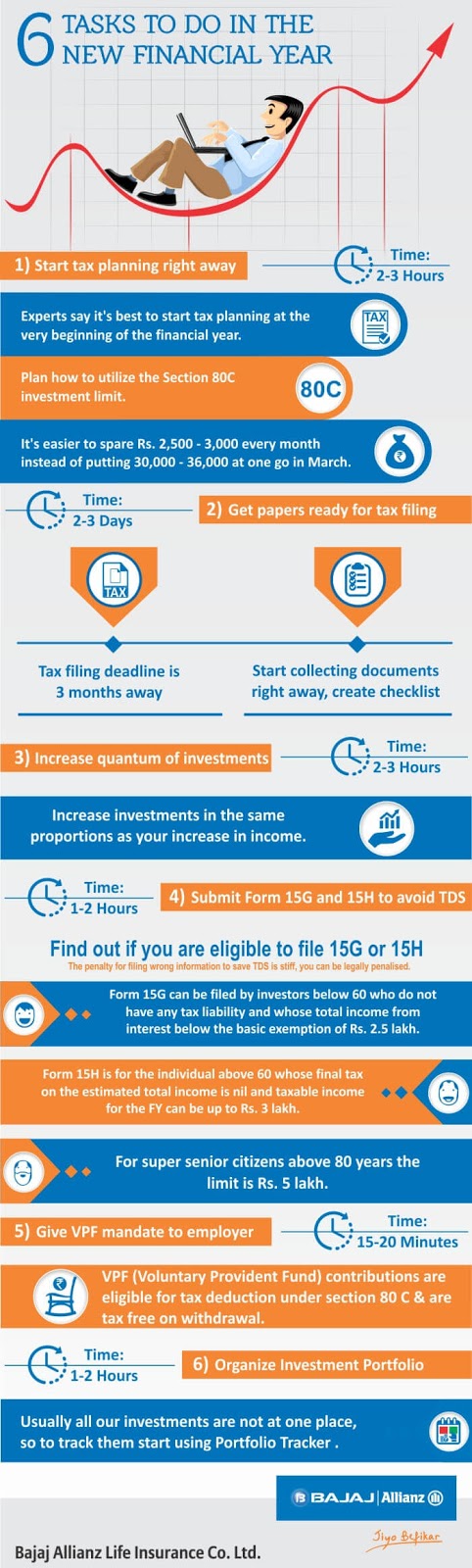

Life insurance benefits you & your family in many ways. One of the major advantages is your family’s protection & along with this protection there are other key factors that are crucial to plan your savings, one of them is tax planning. Life insurance plays a major role as a tax saving investment option by providing various plans like term plan, retirement, savings & investment plans which could be viable tax saving options.

Tax-saving is an important part of financial planning. An intelligent tax-planning strategy can serve the dual objective of helping individuals meet their financial goals and save tax in the process.

Here is a list of some of the best tax saving options, plans and schemes for 2015 that can help individuals maximize tax benefits:

1. Life insurance

Life insurance plays an important role in the individual’s financial portfolio offering security to the individual’s family in case of an eventuality. This makes it the breadwinner’s primary responsibility to take life insurance at the earliest for the family’s security.

Life insurance, be it traditional (endowment) or market-linked (ULIP), offers tax benefits to policyholders on the premiums paid.

There are various life insurance plans like:

Term plans

Endowment plans

ULIPs or unit-linked plans

Money back plans

Regardless of its nature, life insurance plans offer tax benefits to policyholders.

Premiums paid towards life insurance are covered under Section 80C of the Income Tax Act up to a maximum of Rs 1.5 lakhs. Proceeds on death / maturity are tax-free under Section 10(D).If policyis surrendered/terminated within five years, deductions claimed are added to income and taxed accordingly

2. Pension plans

Pension Plans is another form of life insurance. They serve a different end-objective from other Tax Saving Plans like term plans and endowment plans – which are called protection plans. While protection plans are geared to financially secure the individual’s family on his death, pension plans aim at providing for the individual and his family if he lives on.

Contributions towards pensiona re covered under Section 80CCC(sub-section under Section 80C) of the Income Tax Act. The aggregate limit of deduction under all the sub-sections of Section 80C cannot exceed Rs 1.5 lakhs.

On maturity 1/3rd of the accumulated pension amount is tax free with the balance 2/3rd treated as income and taxed at the marginal tax rate. The amount is tax free upon death of beneficiary.

3. Health insurance or Mediclaim

Health insurance or Mediclaim as it is more popularly known, covers expenses incurred from an accident/hospitalization. Mediclaim also covers pre and post-hospitalization expenses, subject to the sum assured

Health insurance offers tax benefits under Section 80D. Insurance premium upto Rs 20,000 for senior citizens and Rs 15,000 for others is eligible for tax benefit. If the policyholder pays Rs 15,000 as premium on his own policy and Rs 20,000 for his parent, a senior citizen, he can claim tax benefit of Rs 35,000 (Rs 15,000+20,000). Maturity value is tax free for sum received under critical illness policies

4. NPS

The NPS or the New Pension Scheme is regulated by the Pension Funds Regulatory and Development Authority – PFRDA. Any citizen of India over the 18 – 60 years age bracket can participate in it. It is extremely cost effective since fund management charges are low. The fund managers manage the money in three separate accounts having distinct asset profiles viz. Equity (E), Corporate bonds (C) and G Government securities (G). Investors can choose to manage their portfolio actively (active choice) or passively (auto choice).

Contributions made to the NPS are covered under Section 80CCD of the Income Tax Act. The aggregate limit of deduction under this section along with Sections 80C, 80CCC cannot exceed Rs 1.5 lakhs.

Given the range of options, NPS is particularly useful for individuals, with varying risk appetites, looking to set aside money towards retirement.

5. Tax-saving mutual funds

Investments in tax-saving mutual funds, also known as equity-linked savings scheme (ELSS), qualify for tax benefits. Tax-saving mutual funds invest in stock markets, among other assets, and are more suited for investors with medium to high risk appetite. Investments are locked in for three years.

Investments towards tax-saving mutual funds are covered under Section 80C of the Income Tax Act up to a maximum of Rs 1.5 lakhs. Proceeds on death / maturity are tax-free under Section 10(D).

Tax-saving is an important part of financial planning. An intelligent tax-planning strategy can serve the dual objective of helping individuals meet their financial goals and save tax in the process.

Here is a list of some of the best tax saving options, plans and schemes for 2015 that can help individuals maximize tax benefits:

1. Life insurance

Life insurance plays an important role in the individual’s financial portfolio offering security to the individual’s family in case of an eventuality. This makes it the breadwinner’s primary responsibility to take life insurance at the earliest for the family’s security.

Life insurance, be it traditional (endowment) or market-linked (ULIP), offers tax benefits to policyholders on the premiums paid.

There are various life insurance plans like:

Term plans

Endowment plans

ULIPs or unit-linked plans

Money back plans

Regardless of its nature, life insurance plans offer tax benefits to policyholders.

Premiums paid towards life insurance are covered under Section 80C of the Income Tax Act up to a maximum of Rs 1.5 lakhs. Proceeds on death / maturity are tax-free under Section 10(D).If policyis surrendered/terminated within five years, deductions claimed are added to income and taxed accordingly

2. Pension plans

Pension Plans is another form of life insurance. They serve a different end-objective from other Tax Saving Plans like term plans and endowment plans – which are called protection plans. While protection plans are geared to financially secure the individual’s family on his death, pension plans aim at providing for the individual and his family if he lives on.

Contributions towards pensiona re covered under Section 80CCC(sub-section under Section 80C) of the Income Tax Act. The aggregate limit of deduction under all the sub-sections of Section 80C cannot exceed Rs 1.5 lakhs.

On maturity 1/3rd of the accumulated pension amount is tax free with the balance 2/3rd treated as income and taxed at the marginal tax rate. The amount is tax free upon death of beneficiary.

3. Health insurance or Mediclaim

Health insurance or Mediclaim as it is more popularly known, covers expenses incurred from an accident/hospitalization. Mediclaim also covers pre and post-hospitalization expenses, subject to the sum assured

Health insurance offers tax benefits under Section 80D. Insurance premium upto Rs 20,000 for senior citizens and Rs 15,000 for others is eligible for tax benefit. If the policyholder pays Rs 15,000 as premium on his own policy and Rs 20,000 for his parent, a senior citizen, he can claim tax benefit of Rs 35,000 (Rs 15,000+20,000). Maturity value is tax free for sum received under critical illness policies

4. NPS

The NPS or the New Pension Scheme is regulated by the Pension Funds Regulatory and Development Authority – PFRDA. Any citizen of India over the 18 – 60 years age bracket can participate in it. It is extremely cost effective since fund management charges are low. The fund managers manage the money in three separate accounts having distinct asset profiles viz. Equity (E), Corporate bonds (C) and G Government securities (G). Investors can choose to manage their portfolio actively (active choice) or passively (auto choice).

Contributions made to the NPS are covered under Section 80CCD of the Income Tax Act. The aggregate limit of deduction under this section along with Sections 80C, 80CCC cannot exceed Rs 1.5 lakhs.

Given the range of options, NPS is particularly useful for individuals, with varying risk appetites, looking to set aside money towards retirement.

5. Tax-saving mutual funds

Investments in tax-saving mutual funds, also known as equity-linked savings scheme (ELSS), qualify for tax benefits. Tax-saving mutual funds invest in stock markets, among other assets, and are more suited for investors with medium to high risk appetite. Investments are locked in for three years.

Investments towards tax-saving mutual funds are covered under Section 80C of the Income Tax Act up to a maximum of Rs 1.5 lakhs. Proceeds on death / maturity are tax-free under Section 10(D).

Wednesday, 13 January 2016

Save Tax & defeat the Tax Monster even at the 11th hour!!

Every year, the month of March springs a wakeup call on many

of us. Suddenly, we are rushing at breakneck speed, going through financial

papers, researching investment instruments, frantically calling the

accountant—the deadline to file income tax returns is once again too close for

comfort.

There are many reasons why we put off filing our tax returns

each year—work, family pressure, and even sheer laziness. We are all wired to

procrastinate; blame it on human nature. The point is this: Should we at all be

procrastinating about something as crucial as our tax planning ?

Last-minute tax

savings: Why it is a problem

Higher financial

burden – Last-minute tax savers often have to scrimp during the last few

months of the financial year because a bulk of their income is now directed

into tax-saving instruments. The problem is compounded by the fact that the

largest chunk of income tax is deducted during the final quarter of the

financial year—i.e. from January to March.

Greater opportunity

for error – Rushing is never a good idea, especially when your financial

well-being is at stake. In the hurry to make good on the potential to save tax

, you could make poor financial decisions and invest in unsuitable products.

For example, a 25-year-old confirmed bachelor with no dependents has little

need for life insurance, but he might buy a policy at the last minute in an

attempt to save tax.

Dangers of

mis-selling – When attempting tax savings at the 11th hour, many people

consult agents and blindly take their advice. You should never take an agent’s

sales pitch at face value because (a) there is the obvious danger of

mis-selling by an unscrupulous agent and (b) even an honest agent may not be

sufficiently aware of your financial condition. It is necessary to do your own

research, which is not possible at the last minute.

Processing takes time – Note that buying a tax saving

investment is not like buying groceries; there are procedures and it takes

time. Furthermore, there may be unexpected delays for various reasons. Postpone

your tax planning until too late and you

run the danger of missing your tax filing deadline.

Tax planning: Why you

should start early

Make good investments

– You should ideally give yourself time to research tax-saving products so that

you are certain of getting a good deal. Starting early also ensures that you

benefit from the potentially higher rate of returns than your savings bank

account would offer you.

Spread out the burden

– If you start planning early, you can spread out the cost of making smart

investments. Smart planning ensures that you do not have to adopt austerity

measures as January comes around in a bid to do save as much tax as possible.

Look at the bigger

picture – The longer you procrastinate, the greater the possibility that

you will be looking at tax savings through blinkers: Your main goal will then

be to save taxes in that particular year rather than on which tax-saving

investment instruments benefit you over the long term. This really is the most

important factor in favour of starting early, as it enables you to plan for

your financial future in a better and more holistic way.

Monday, 11 January 2016

New-age ULIPs facilitate more efficient tax planning

Amongst all insurance plans, new age Unit Linked Insurance

Plans (ULIPs)are a category of goal-based financial solutions that offer dual

benefits of protection and Investment offering the advantage of Tax Saving Plans to the customer. A Unit linked

Insurance Plan is linked to the markets and offers the flexibility to invest

the units in equity or debt funds depending upon the customer’s risk appetite.

The investment risk is borne by the policy holder. In this respect, a new age

ULIP acts somewhat like a mutual fund with added benefit of life cover and it

offers more efficient tax saving by charging much lesser than mutual funds.

ULIPs now have charges capped and offer better returns

In the past, ULIPs suffered from certain limitations like

high charges, sale keeping in mind a short term horizon, and lack of active

involvement by the customer. In 2010, the IRDA issued new guidelines for ULIPs

in order to improve the returns for investors by reducing charges and to ensure

that the new product is sold and bought as a long-term protection and savings

tool. We have gone a step ahead by launching an online ULIP called Click2Invest

which charges for only mortality and fund management making it more cost

effective than a mutual fund.

Efficient tax saving using low charge ULIPs

ULIPs offer comprehensive tax benefits. The premium paid up

to Rs 100,000 in a year is eligible for tax benefit under section 80C. The

maturity benefit for policies with insurance cover with 10 times of the premium

or more is tax free under section 10(10D). Moreover, the returns under various

types of funds including debt funds are also tax free. Partial withdrawals made

at various points in time are also tax free.

The above tax benefits along with lower charges offer a

win-win situation for the customer.

Conclusion

Tax planning should not be done in isolation and one must

align this activity with the larger investment needs in a well planned and

systematic manner to gain maximum benefits. The habit of financial planning

should be cultivated right from the early stages of career. Ideally this

exercise should be done at the start of every financial year where one should

make an assessment of allocation of available funds to ULIP- long-term tax-saving

instruments.

Subscribe to:

Comments (Atom)